According to Capm Which of the Following Events Would Effect

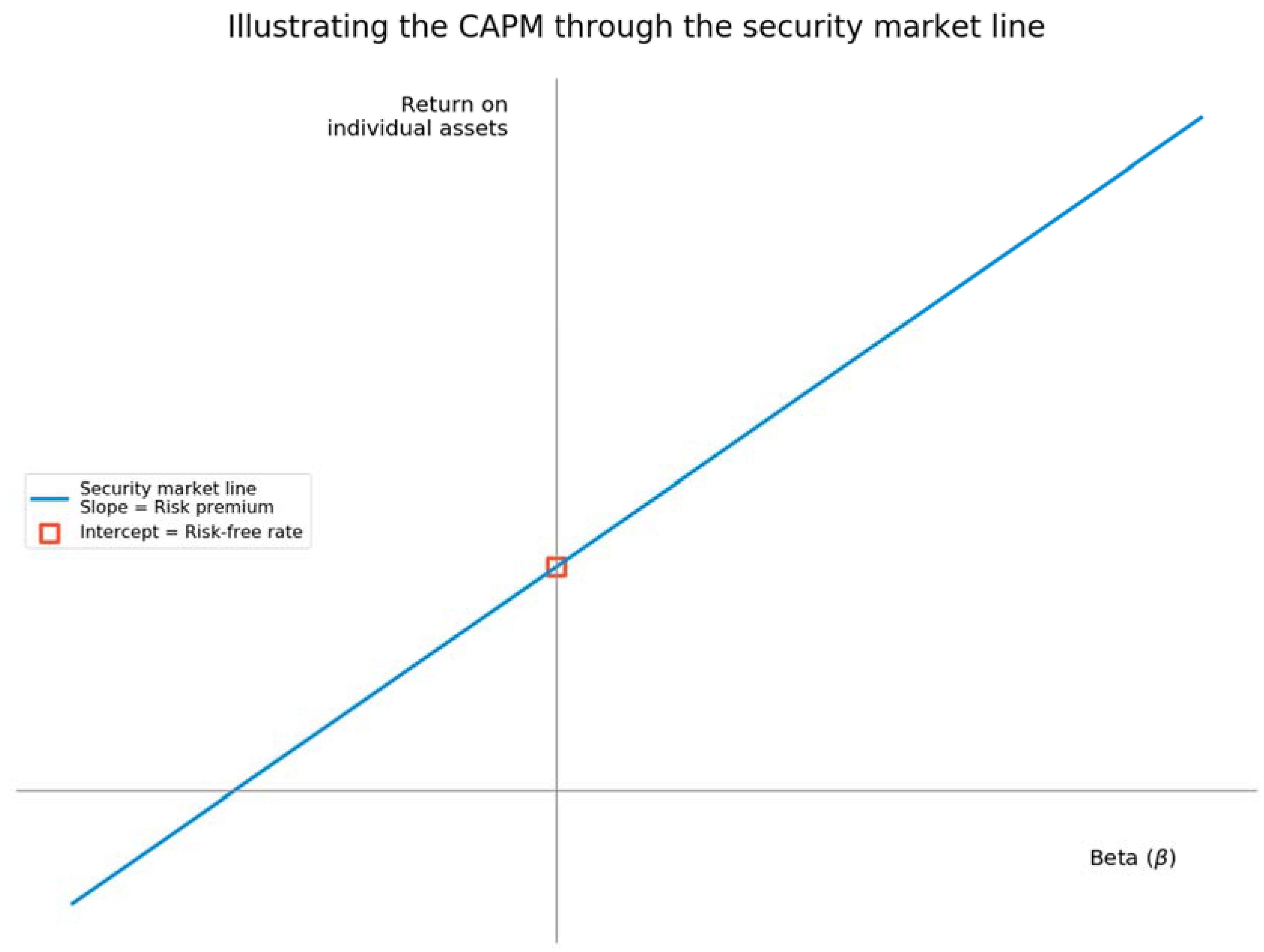

Betas Role in CAPM. Return Risk-free rate Beta Market Return Risk-free rate.

Encyclopedia Free Full Text The Capital Asset Pricing Model Html

The Federal Reserve tightens interest rates in an effort to fight inflation.

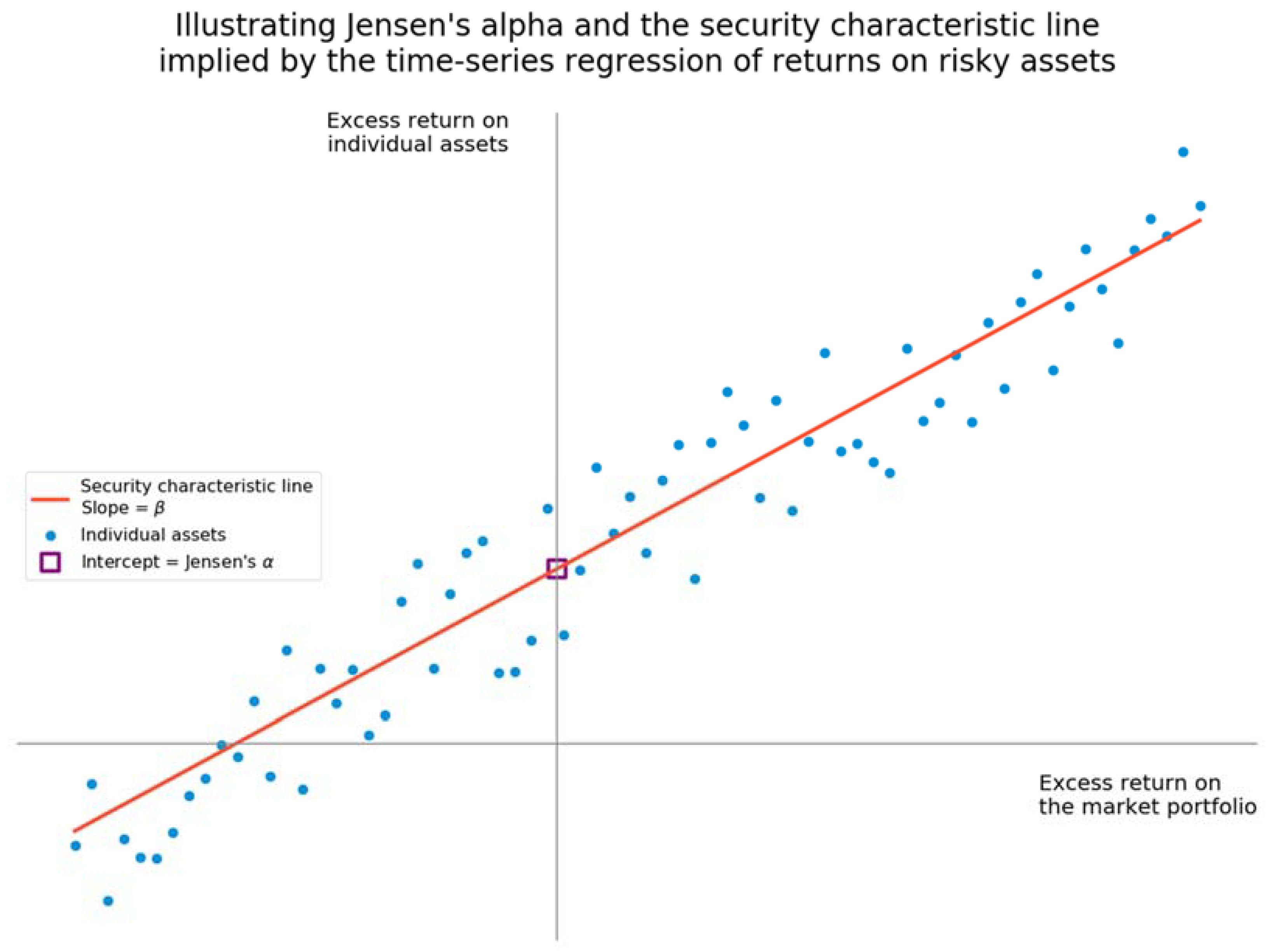

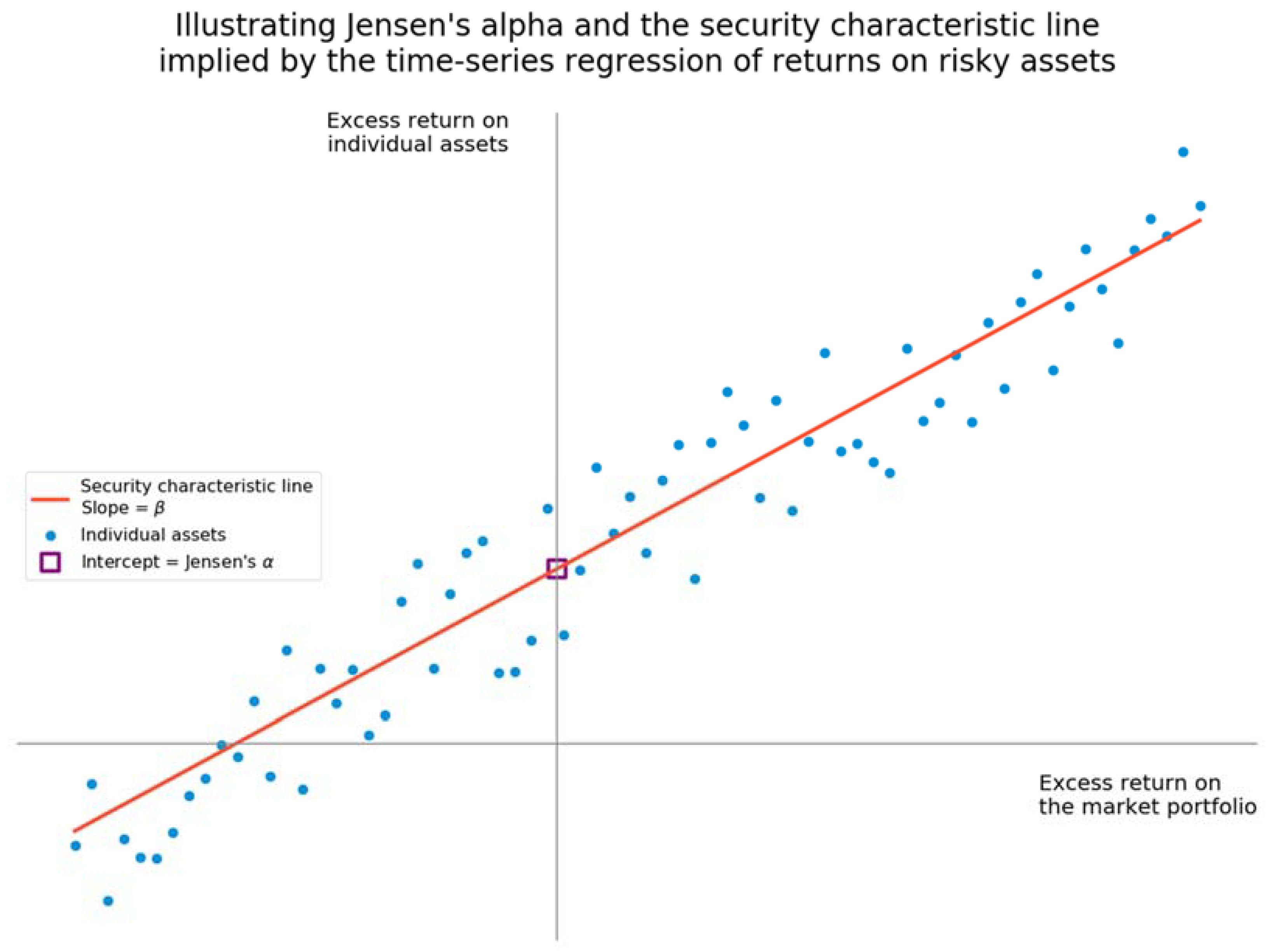

. Beta is calculated by regressing the percentage change in stock prices versus the percentage change in the overall stock market. In 2021 there were 83644 cases of child abuse and neglect reported in Massachusetts. The purpose of this study is to determine the effect of the stock market conditions at different estimation periods for capital asset pricing model CAPM variables on the ability of the CAPM to explain the change in stock returns applied to the.

That the APT requires an even larger number of unrealistic assumptions than the. CAPM Beta calculation can be done very easily on excel. Dividing the market into deciles based on their betas shows an increasing.

The companys stock price hits a new high. According to Michael Porter there are 5 determinants of competition. Mergers and acquisitions based on the market data is event study 1 developed and used for the.

Capital Asset Pricing Model Homework Problems Portfolio weights and expected return 1. As Betas differ according to the market proxy that they are measured against then in effect CAPM has not been and cannot be tested. Answer An increase in the personal tax rate.

It measures a stocks relative volatilitythat is it shows how much the price of a particular stock. The following past rates of return are to be used to calculate the two stocks beta coefficients which are then to be used to determine the stocks required. According to the Capital Asset Pricing Model CAPM which one of the following statements is false.

Record a journal entry for the following events a record Question 3. Which one of the following should earn the most risk premium based on CAPM. Consider a portfolio of 300 shares of rm A worth 10share and 50 shares of rm B worth 40share.

Its use of several factors instead of a single market index to explain the risk-return relationship B. According to CAPM the amount of reward an investor receives for bearing the risk of an individual security depends upon the. CAPM Beta Calculation in Excel.

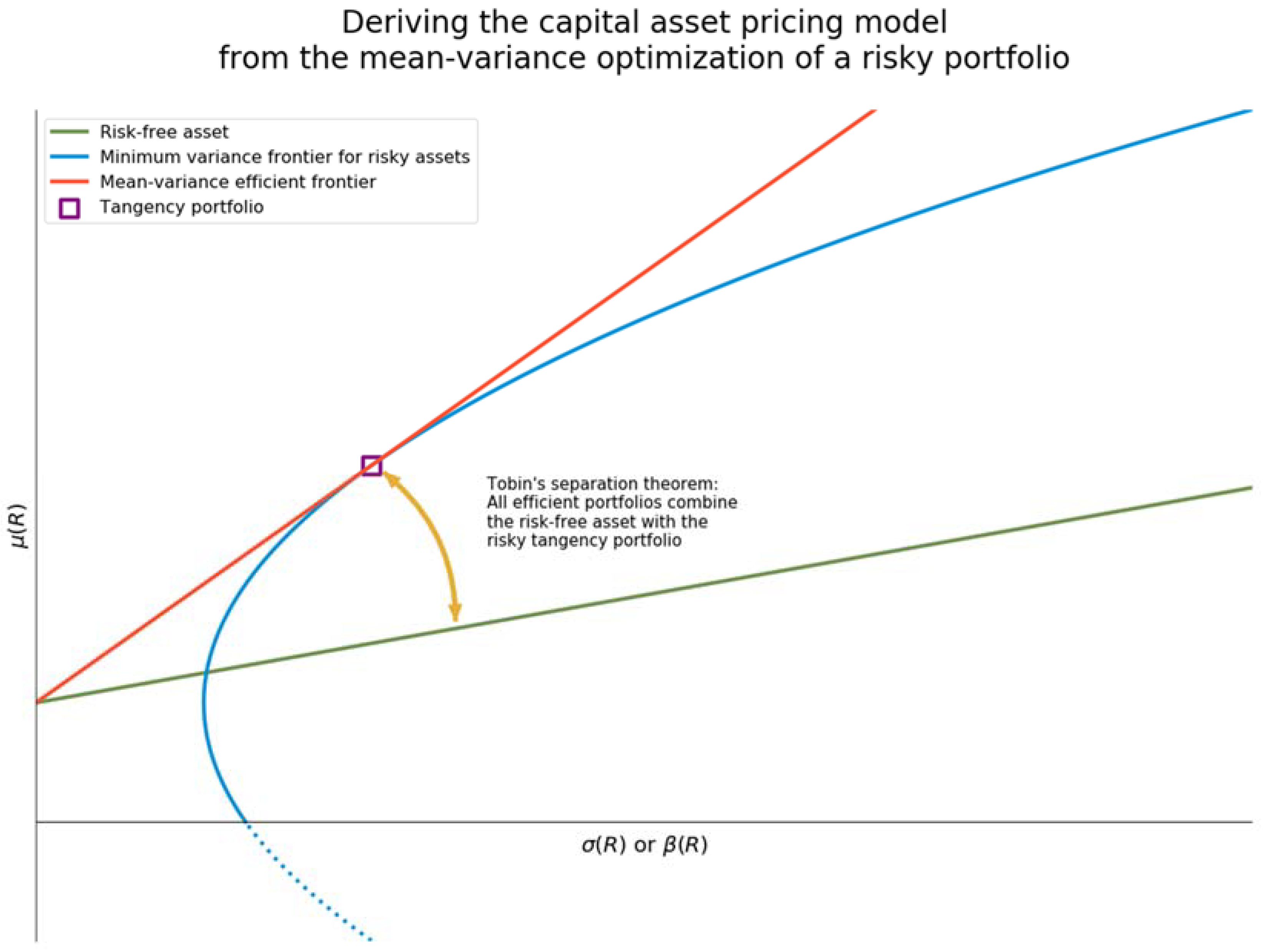

The CAPM is assumed to be a valid method for selecting stocks but the expected return for any given investor such as you can differ from the required rate of return for a given stock. The expected rate of return on a security increases in direct proportion to a decrease in the risk-free rate. Capital Market Asset Pricing Model CAPM incorporates a relationship explaining how assets should be priced in the capital market.

Stock Q has a beta equal to 16 and Stock P has a beta equal to 08. Calculate the expected return and price of a stock under the following conditions using the Capital Asset Pricing Model CAPM. As Betas differ according to the market proxy that they measure against then in effect CAPM has not been and cannot test.

That is the approach of the present study was to test the theory of capital asset pricing model at a different level of market return at a different basis of estimation periods of capital asset pricing model variables 612 months. Based on this information according to the capital asset pricing model CAPM which of the following statements is correct. The measure of systematic risk according to Sharpes CAPM is the stocks beta or sensitivity of returns of the stock to market returns.

You expect a return of 8 for stock A and a return of 13 for stock B. The expected rate of return on a security increases as its beta increases. According to the index model covariances among security pairs are A due to the influence of a single common factor represented by the market index return.

A fairly priced security has an alpha of zero. According to CAPM beta is the only relevant measure of a stocks risk. B extremely difficult to calculate.

A What is the total value of the portfolio what are the portfolio weights and what is. The introduction of non-systematic risk as a key factor in the risk-return relationship C. According to the Capital Asset Pricing Model CAPM which one of the following statements is false.

We may recall that CAPM states that. Market risk premium and the amount of systematic risk inherent in the security. All else equal the fair intrinsic price of a stock should fall if the market risk premium decreases according to the CAPM model False If a stock is riskier than the average stock its required return will be greater than the market risk premium according to the CAPM model.

An increase in the companys operating leverage. Capital Asset Pricing Model and Variations. If the stocks beta is the best explanation of risk then the small-firm effect does indicate an inefficient market.

Although CAPM takes place in April child abuse and neglect happens every day. The expected rate of return on a security increases in direct proportion to a decrease in the risk-free rate. The purpose of this research is try to create Capital Asset Pricing Model CAPM alternative model at Indonesia Stock Exchange IDX.

Bodie - Chapter 07 60 Difficulty. In the theoretical version of the CAPM the best proxy for the risk-free rate is the short-term. Record a journal entry for the following events a record the service cost for 20x2 b record the net interest for 20x2 c record the experience lost on asset d record the actuarial gain to change in assumptions e record the contribution to the fund for 20x2.

One of the main problems with the arbitrage pricing theory is _____. One of the popular methods employed in the methodology of financial effects of. Stock with a beta of 138.

Which of the following events is likely to encourage a company to raise its target debt ratio other things held constant. The required rate of return for Stock Q rQ should be 16 times greater than the required rate of return for Stock P rP. We may recall that CAPM states that-.

According to the CAPM investors require a risk premium as compensation for. Which of the following phenomena would be either consistent with or a violation of efficient market hypothesis. Technically speaking Beta is a measure of stock price variability in relation to the overall stock market NYSE NASDAQ etc.

Explain and draw a graph of the relationship. C related to industry-specific events. The expected rate of return on a security increases as its beta increases.

According to the capital asset pricing model CAPM how does risk affect the expected returns on assets. Adverse Childhood Experiences ACEs including physical sexual and emotional abuse neglect household substance abuse household mental illness and domestic violence can have lasting negative. The capital asset pricing model were not exposed to the conditions of measuring the returns.

The capital asset pricing model CAPM is the oldest of a family of models that estimate the cost of capital as the sum of a risk-free rate and a premium for the risk of the particular security. A fairly priced security has an alpha of zero.

Encyclopedia Free Full Text The Capital Asset Pricing Model Html

Capm Theory Advantages And Disadvantages F9 Financial Management Acca Qualification Students Acca Global

Encyclopedia Free Full Text The Capital Asset Pricing Model Html

No comments for "According to Capm Which of the Following Events Would Effect"

Post a Comment